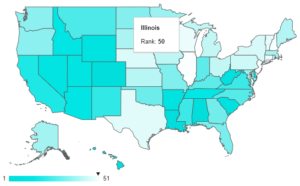

UNDATED – Illinois has the second highest real-estate property tax rate in the United States, according to the recent study. Personal-finance website WalletHub released a report naming Illinois second highest with a statewide average of 2.30%, nearly double the national average. The typical homeowner in Illinois pays around $4,200 annually in property taxes. Locally, Of LaSalle, Bureau, and Putnam Counties, LaSalle has the highest property tax, at around $2,600 for a property valued around $125,000.

Source: WalletHub

It looks like you are not a member of VIP Club yet. Please fill out the form below to access the page and join the VIP Club